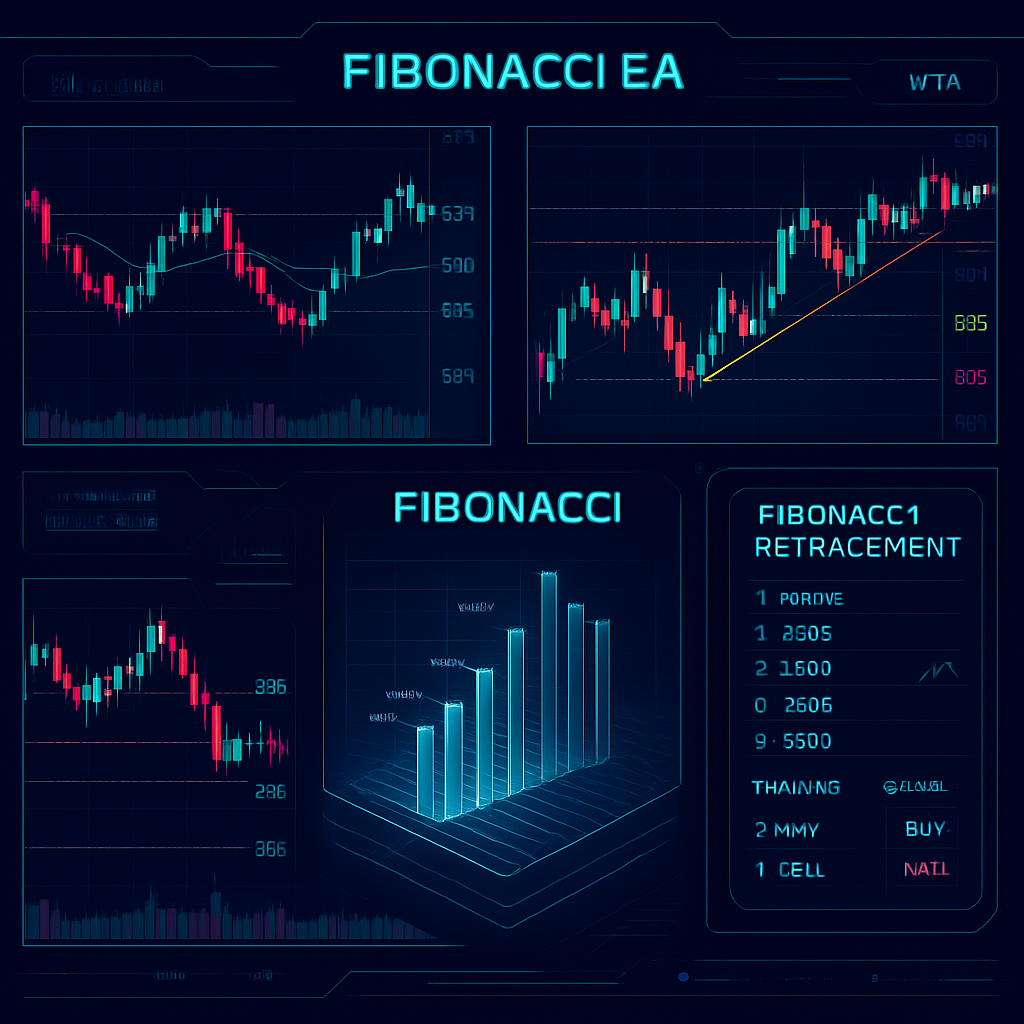

Fibonacci Retracement System

Advanced algorithm for automated market analysis and decision making

RM125.00

Concept: Price retraces to a key Fibonacci level (38.2%, 50%, 61.8%) before continuing in the main trend.

Usage: Enter on retracement, SL beyond the next level, TP at Fibonacci extension.

Pairs well with: Trendlines, Support & Resistance, Order Blocks.

Unlock your trading potential with the advanced Fibonacci EA Trading Software. Engineered to meticulously analyze financial charts, this powerful tool leverages proven Fibonacci retracement strategies to deliver precise buy and sell signals for optimized trading decisions. Experience effortless automation, user-friendly setup, and real-time analytics designed for traders of all experience levels. Take control of your financial future—accelerate your success with innovative technology that adapts to every market condition. Available for instant digital download; compatible with all major trading platforms. Upgrade your trading game today!

How it works (quick guide)

Trend: Simple MA filter—only buys above MA, only sells below MA.

Swing & Fib: Finds the latest confirmed swing high/low, plots internal Fib math, and places limit orders at 38.2/50/61.8 (you can toggle each).

Stop-Loss: Choose ATR×multiplier or fixed pips.

TP: Uses Fibonacci extensions (default 1.272, fallback 1.618).

Money Management: If

UseRiskMM=true, lot size is computed from Risk% of balance and your SL distance; else usesFixedLot.Spread control: Skips actions when spread exceeds

MaxSpreadPoints.Break-even: When price moves

BE_TriggerPipsin your favor, SL moves to entry ±BE_OffsetPips.Auto-cleanup: If the structure flips or swing anchors change, pending orders are cleared (toggle via

AutoDeleteOnNewSwing).

Suggested settings (start conservative)

Major pairs (5-digit):

MaxSpreadPoints = 20–25Timeframe H1 GoldATRPeriod = 14,ATRMultiplier = 1.5–2.0RiskPercent = 0.5–1.0BE_TriggerPips = 8–12,BE_OffsetPips = 2TrendMAPeriod = 100EMAEnable

UseFib38&UseFib61, keepUseFib50on only if drawdowns acceptable.

Volatile pairs: increase

TrendMAPeriod, or raiseATRMultiplier.

Notes & tips

Backtest on your broker’s data first; tweak

SwingLookbackBarsandConfirmBarsto fit the timeframe (start with M15–H1).StopLevel constraints: If your broker enforces minimum distances, you may need to nudge SL/TP away from price.

For market entries on touch, set

UseLimitOrders = false(the EA will enter at market instead of placing limits).You can layer risk per level by lowering

RiskPercentor switching toFixedLotfor uniform sizing across levels.

If you want to add any functions or confirmations, contact me to discuss.

Freedom

Break free from the system and thrive.

Wealth

Power

support@blackcode-ea.com

Connect Now